With the projected growth to 216.8 million digital banking users in the U.S. by 2025, the demand for flawless app performance is at an all-time high.

Digital bank users are different from traditional bank users–52% seek customer service in their app as their first step instead of a voice call. Not offering seamless assistance to customers on their preferred channel may frustrate them and eventually give them a reason to switch to the competitor.

So, how can banks ensure seamless performance of their apps?

The answer is Application Performance Monitoring (APM), which is not just crucial for ensuring uninterrupted service; it is pivotal for improving user experience.

By enabling real-time system monitoring, quick problem resolution, and ongoing enhancements to digital infrastructure, APM ensures that banks maintain and grow their customer base by delivering consistently reliable app performance.

This guide outlines seven strategic ways banks can use APM to boost their app performance.

7 Ways Banks Can Boost Performance with APM Solutions

APM solutions equip banks with essential tools to optimize performance, stability, and user experience on digital banking platforms. Here are seven ways banks can enhance performance using APM:

1. Faster Loading Times

With nearly half of all bank customers now managing their accounts through mobile applications, these platforms must provide seamless and consistent performance.

However, these banking applications often struggle with prolonged load times, particularly during peak usage. This slowdown can lead to user dissatisfaction and a shift towards competitors.

Application Performance Monitoring (APM) offers a solution by delivering in-depth insights into the causes of these delays, whether they stem from data retrieval, processing inefficiencies, or slow rendering. APM tools help identify underperforming components and inefficient database queries, enabling developers to target their improvements effectively.

Additionally, APM’s real-time monitoring capabilities allow for on-the-fly adjustments in server setups or resource distribution, helping applications maintain high performance even under heavy loads.

This proactive approach not only reduces wait times but also boosts the application’s overall reliability, significantly enhancing the user experience.

2. Hassle-Free Login

Customers expect seamless login experiences for their banking apps, ensuring quick access to accounts and smooth transactions.

However, login issues can arise, causing frustration and hindering access. One major bank recently faced this problem, with thousands of customers unable to log in or perform transactions, leading to widespread dissatisfaction.

APM can alleviate these issues. By monitoring various components, such as authentication servers and network connections, APM detects and logs errors during the login process. It identifies slow response times, failed login attempts, and system errors in real-time. This data is logged and analyzed to pinpoint the root causes of performance issues.

Additionally, APM tracks user interactions, offering insights into behavior and preferences. This information helps banks optimize the login process, making it more efficient and user-friendly.

Implementing an APM solution enhances login reliability, reduces user frustration, and boosts overall satisfaction, ensuring a smoother and more reliable banking experience.

3. No More Data Breaches

Bank apps aim to securely manage sensitive personal and financial information, strengthening user-bank relationships and enhancing the mobile banking experience.

Despite these goals, the U.S. financial sector encountered 744 data breaches in 2023, revealing critical vulnerabilities. These breaches not only resulted in substantial financial losses but also diminished customer trust and disrupted operations, prompting users to switch to more secure platforms.

To tackle these issues, APM tools are essential. The tool monitors application data for anomalies and signs of potential breaches, such as unauthorized access attempts or unusual data transfer patterns.

By analyzing user activity and network traffic, APM swiftly identifies and mitigates vulnerabilities. Real-time alerts to security teams enable immediate responses, significantly enhancing security measures and safeguarding user data against cyber threats.

4. Minimizes Downtime

Bank apps aim to provide smoother transactions and reliable account access, increasing customer satisfaction and trust. This also improves internal operations, allowing bank employees to focus on productivity without constantly attending to system issues.

However, recent data indicates that 80% of businesses have encountered downtime over the last three years, leading to customer frustration, financial losses, and lost revenue as customers seek more dependable services.

APM tools effectively mitigate this downtime by monitoring all aspects of app operations, including server load, response times, network bottlenecks, and database performance.

When APM identifies an issue, such as a slow database query or a memory leak, it immediately alerts the IT team, allowing them to address the problem before it causes major downtime.

This proactive approach reduces downtime, ensures optimal app performance, and helps banks avoid costly unplanned outages, maintaining a consistent digital banking experience.

5. Handles Heavy Traffic Smoothly

With mobile banking users expected to reach 116.4 million by 2024, ensuring smooth and reliable app performance is essential. Ideally, customers should enjoy fast and seamless transactions while banks benefit from efficient operations.

However, heavy traffic often strains banking apps, causing slower response times and degraded performance. This can result in scalability issues and overloaded servers, leading to significant delays.

APM tools address these issues by providing detailed insights into system resource utilization, such as CPU, memory, disk I/O, and network bandwidth. These insights help banks anticipate future resource needs, ensuring their infrastructure can handle peak loads.

By identifying trends in resource usage, APM tools enable IT teams to make informed decisions on scaling and optimizing resources. This approach prevents bottlenecks and maintains optimal performance, ensuring a seamless user experience.

6. Lowers Meantime To Resolution(MTTR)

Bank apps with lower MTTR ensure continuous, seamless transactions and fewer service disruptions, enhancing user satisfaction and reliability.

Performance issues or unavailability can lead to user frustration, financial losses, and damage to reputation. High MTTR results in extended downtime and increased customer inquiries, straining support resources and causing lengthy wait times and dissatisfied customers.

APM tools reduce MTTR by providing real-time insights into application performance and pinpointing issues. They offer comprehensive visibility into metrics, logs, and traces, allowing IT teams to quickly diagnose problems. Automated root cause analysis and intelligent alerting streamline troubleshooting, minimizing downtime.

These tools also facilitate proactive maintenance by identifying performance trends and potential issues before they escalate, ensuring faster resolution times and enhanced reliability.

7. Enhances End-User Experience

According to McKinsey & Company, improving customer experience can reduce churn by up to 15%. Banks can achieve this by tailoring services to individual customer needs, simplifying processes, and ensuring quick, hassle-free transactions.

Poor user experience leads to dissatisfaction and loss of trust. Frustrated customers often switch to competitors, impacting loyalty and retention.

APM provides real-time data on app performance, allowing quick identification and resolution of issues. These tools monitor metrics, logs, and traces to detect bottlenecks before they affect users. This ensures fast response times and reliable service, maintaining smooth interactions.

Proactive monitoring allows banks to address issues early, reducing downtime and enhancing overall customer satisfaction. By optimizing performance, APM tools help banks stay competitive and improve the end-to-end user experience.

Elevate Your Bank App’s Performance with Avekshaa’s APM Services

Avekshaa Technologies is renowned for its proven track record of delivering tangible results rather than just making promises.

In a recent scenario, a major cloud services company was offering financial services through a cloud-based core banking product. However, one of its key clients using a rural banking service faced severe performance-related disruptions.

Avekshaa didn’t merely offer assistance; it drove transformative results, significantly boosting the bank’s operational efficiency and customer satisfaction.

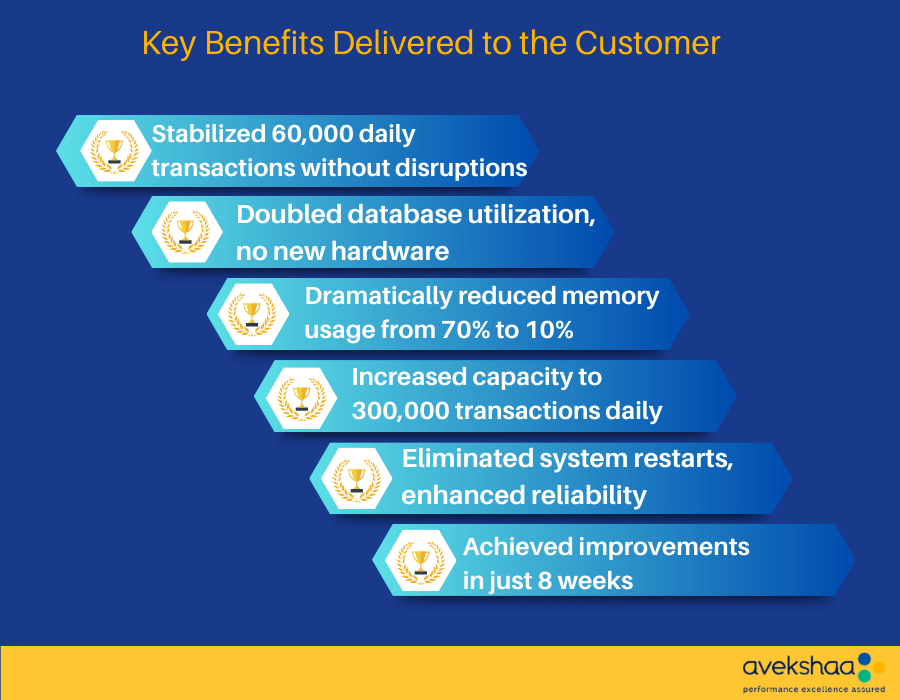

Emerging as the unequivocal solution, Avekshaa revolutionized the bank’s performance and scalability, eliminating multiple restarts and enhancing the user experience. The benefits reaped by the customer were both clear and profound.

Avekshaa’s distinction lies in its sterling track record of excellence, particularly within the NBFC and banking sector. Achieving over a 150% average performance improvement across projects, Avekshaa has earned customers’ trust for over 12 years.

Here are compelling reasons to choose Avekshaa for APM Services:

- Deep Expertise: Avekshaa’s team of APM experts has extensive experience implementing and maintaining APM solutions and is well-versed in best practices for ensuring optimal performance.

- Proactive Monitoring: Avekshaa provides 24/7 proactive monitoring and support, ensuring timely identification and resolution of performance issues before they impact users.

- Solution-Driven Approach: Avekshaa focuses on finding solutions. If APM doesn’t suffice, they supplement it with their Application Performance Engineering solution.

- Continuous Improvement: Avekshaa collaborates with clients on an ongoing basis to continuously improve the APM solution, utilizing data and insights to optimize performance and achieve business objectives.

- Cost-Effectiveness: Avekshaa’s APM implementation and maintenance services offer high ROI, maximizing the value of your investment.

- Customization: Avekshaa understands the uniqueness of every business, takes time to understand specific needs and goals, and customizes the APM solution accordingly.

- Trusted Partner for Global Corporations: Endorsed by leading companies such as Vodafone, HDFC Bank, TATA CAPITAL, NSE, MAGMA, Indiabulls, and HSBC, Avekshaa’s reputation for credibility, reliability, and adherence to high global standards is well-established.

Avekshaa’s cutting-edge solutions promise to elevate your application performance while ensuring perfect harmony with your business objectives. Make your first move by completing our “Contact Us” form today.

FAQs

1. What is Application Performance Monitoring (APM)?

Application Performance Monitoring refers to monitoring and managing software applications’ performance to ensure they run smoothly and efficiently.

2. Why is APM important for banks?

Slow or unresponsive apps can lead to lost transactions, frustrated customers, compliance issues, and financial losses.

3. How can APM solutions help banks?

APM solutions provide deep visibility into application performance, allowing banks to quickly identify and resolve issues before they impact end-users.

4. What are some common use cases for APM in banking?

Common use cases include monitoring online/mobile banking apps, ATM/POS systems, loan processing apps, trading platforms, and core banking solutions.

5. Who’s the top APM service provider?

Avekshaa Technologies leads the pack, specializing in Performance, Availability, and Scalability (P-A-S) engineering. Their AI-driven testing solutions cater to diverse sectors, ensuring top-notch service. With a proven history of successful collaborations with multinational corporations, they’re the top choice for all-encompassing APM requirements.