The Income Tax Department (ITD) of India aimed to revolutionize the IT filing experience for its citizens. The crucial first step in this transformation was to integrate the disparate e-Filing and Centralized Processing Center (CPC) platforms into a unified e-Filing and CPC platform.

A leading Systems Integrator (SI) was selected as the Managed Services Partner to design, develop, implement, operate, and maintain the Integrated ITD-2.0 Platform. To ensure the highest level of quality, the SI sought to involve a team of experienced experts to independently validate the platform’s performance, availability, and scalability. Avekshaa Technologies was onboarded as a trusted partner to play this critical role.

The Role of Avekshaa Technologies

While the SI acted as the maker of the new integrated platform, Avekshaa served as the checker throughout the program lifecycle, providing assurance from performance, availability, and scalability (P-A-S) standpoints.

Key Challenges Addressed

Scalability

The incumbent Income Tax portal historically supported 4.9 million filings on peak days. The new platform was expected to handle 10 million filings on peak days, maintaining performance levels of over 400 filings per second.

Architecture Optimization

The platform’s architecture included numerous open-source and commercial off-the-shelf (COTS) products, each with distinct performance characteristics and scalability factors. Optimization of each component was essential.

Microservices and DevOps

The platform used a microservice-based architecture deployed on a private cloud, fed through an end-to-end DevOps pipeline. Each service required performance optimization to ensure seamless workflow completion within desired timelines.

API Integration

The platform’s faceless engines exposed APIs for seamless third-party integrations, including tight integrations with internal and external subsystems like NSDL, OLTAS, Insights, ITBA, etc. Ensuring the integration architecture’s resilience was critical.

Agile Development

With an agile development approach delivering millions of lines of code, it was crucial to conduct both automated and manual code quality checks to identify stress points introduced in multi-wave development.

Evolving Requirements

The project faced ever-changing and last-minute requirements, adding complexity to the development process.

Avekshaa’s Checker Approach

Avekshaa played an independent validator role throughout the development program, conducting an independent QoS review of architecture, design, code, and configuration.

Shift-Left Approach: Avekshaa mitigated P-A-S issues early in the program lifecycle, unlike the industry norm of late discovery in the SDLC.

Architecture Review: Conducted both manual and POC-based reviews to establish the capability to handle performance and scalability requirements.

Integration Architecture Review: Ensured resiliency of the integration architecture.

Performance Testing Strategy: Defined a robust strategy covering all possible scenarios.

Performance Benchmarking: Analyzed performance benchmarks across critical components.

Code Quality Reviews: Conducted automated and manual reviews to ensure high code quality.

Performance Testing and Bottleneck Analysis: Identified and addressed performance bottlenecks throughout the testing phase.

Business Impact

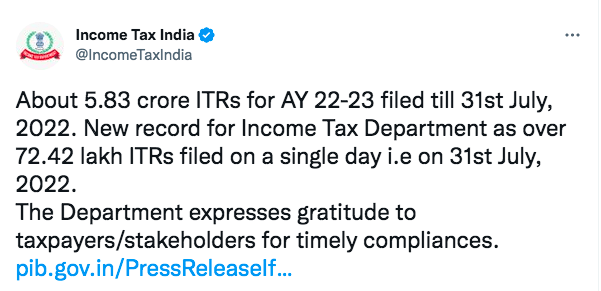

The ITD-2.0 Platform successfully went live, supporting a maximum filing of 7.2 million on July 31, 2022, a 47% increase from the previous year, and handling 570 transactions per second (TPS).

With Avekshaa’s involvement, the SI achieved significant outcomes:

Early Risk Identification: 35% of risk items were identified early in the program lifecycle, making them easier and cheaper to address.

Improved Code Quality: Code quality improved by 25% across releases.

Cost-Effective Testing: Scaled up concurrent testing for 500,000 users using cost-optimized testing solutions, proving to be 60% cost-effective.

Timely Launch: Achieved ambitious time-to-launch timelines.

The ITD-2.0 Platform’s success was widely recognized, with the Income Tax Department sharing their satisfaction in a Twitter post.