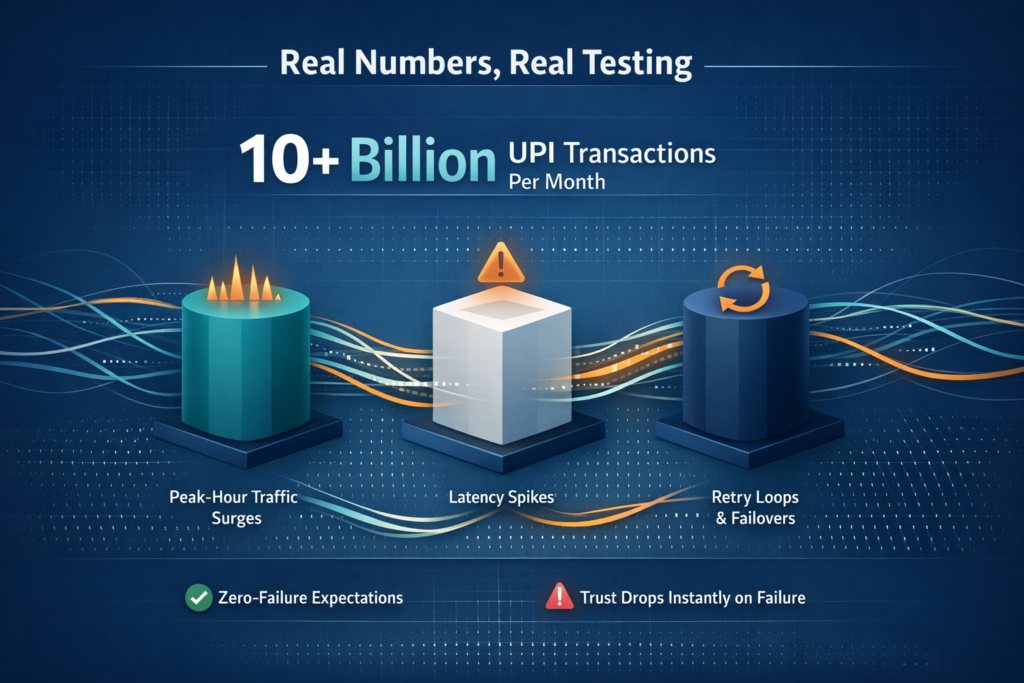

Real Numbers, Real Testing.

UPI apps are no longer judged by how many features they offer. For most users, payments are expected to work instantly and quietly in the background. When they do not, frustration is immediate and trust drops fast. In 2026, performance has become the real battleground for UPI apps.

Google Pay, PhonePe, and Paytm dominate daily transaction volumes in India. According to National Payments Corporation of India (NPCI), these platforms collectively process over 10 billion UPI transactions monthly. Each handles massive traffic at scale, especially during festivals, salary days, and flash sales. But performance is not just about speed, it is about reliability, recovery, and how apps behave when things go wrong.

This blog looks at performance through a practical lens. Not to declare a winner, but to understand where each app performs well and where trade-offs appear.

Overview

As UPI becomes a critical part of everyday payments in India, users expect apps to work instantly and reliably, especially during peak moments. Research from McKinsey shows that 75% of Indian consumers now use digital payment methods regularly, with UPI leading the charge. In 2026, performance has emerged as the real differentiator between leading UPI apps, often influencing trust more than features or rewards.

This blog takes a practical look at how Google Pay, PhonePe, and Paytm perform under real-world conditions. Instead of declaring a winner, it defines what performance truly means in digital payment systems and compares how each platform handles transaction success, latency, retries, UI responsiveness, and failure communication during peak load scenarios. By being transparent about testing assumptions and focusing on user experience, the blog offers balanced insights and closes with lessons that banks and fintechs can apply to their own payment systems.

Key Takeaways

| Area | Key Insight |

|---|---|

| Meaning of Performance | UPI app performance includes success rate, latency, recovery behavior, and user messaging, not just speed. |

| User Trust | Payment failures or unclear delays quickly reduce user confidence in financial apps. |

| Peak Load Reality | Festival days, salary credits, and flash sales test UPI apps more than average daily traffic. |

| Google Pay Strength | Strong UI responsiveness and calm, clear failure handling under stress. |

| PhonePe Strength | High reliability and balanced retry behavior during large transaction spikes. |

| Paytm Strength | Competitive success rates backed by a broad ecosystem, with trade-offs in UI heaviness. |

| Retry Strategy | Aggressive retries can help or hurt depending on how congestion is handled. |

| Failure Messaging | Clear communication during issues is as important as fast recovery. |

| No Single Winner | Each app makes deliberate performance trade-offs based on product design choices. |

| Industry Lesson | Banks and fintechs should design for peak stress scenarios, not just ideal conditions. |

What performance really means in UPI apps

Performance in UPI apps goes far beyond how fast a screen loads. From a user perspective, it includes several key aspects that align with application performance engineering principles.

- Transaction success rate matters first. A fast app that fails payments is not reliable. According to Gartner research, even a 1% reduction in transaction success rate can lead to significant revenue loss in digital payment platforms.

- Latency matters next. Users notice even small delays when waiting for payment confirmation. Real-time performance monitoring shows that delays beyond 3 seconds significantly impact user satisfaction.

- Failure recovery is critical. When something goes wrong, how quickly and cleanly the app recovers shapes user confidence through effective incident response.

- Finally, clear messaging matters. Silence or vague errors increase anxiety during financial transactions.

Together, these factors define whether an app feels trustworthy.

Is Your Payment Platform Ready for Peak Traffic?

Get a Performance Health Check

Our performance engineering experts will stress-test your payment systems and identify bottlenecks before they impact your customers during critical moments.

Testing assumptions and transparency

It is important to clarify how this comparison is framed.

The observations here are indicative and based on real-world usage patterns, public behavior, and performance characteristics seen during peak periods. These are not internal metrics from the companies themselves. Network conditions, device types, and external dependencies all influence outcomes.

The goal is transparency. By clearly stating assumptions and metrics through performance testing methodologies, the comparison stays grounded and trustworthy.

Metrics used for comparison

To keep things simple and meaningful, the comparison focuses on five areas aligned with industry-standard APM practices.

- Transaction success rate reflects how often payments complete without user retries.

- Latency looks at how long users wait for confirmation during peak load.

- Retry behavior examines how apps handle failed attempts and whether retries help or hurt.

- UI responsiveness considers whether the app remains usable under stress.

- Failure messaging evaluates how clearly apps communicate issues to users through effective observability.

These metrics together reflect real user experience.

Performance during peak load scenarios

UPI performance is truly tested during short, intense spikes. Festivals, major online sales, and salary credit days generate sudden surges in traffic. According to Reserve Bank of India data, UPI transaction volumes can spike by 300-400% during major festivals like Diwali. These moments matter more than average daily performance.

During peaks, systems face concurrency pressure, downstream latency, and retry amplification. Apps that handle these moments gracefully through robust performance engineering earn long-term user trust.

Google Pay performance characteristics

Google Pay is often associated with a clean and minimal interface. Under normal and moderate peak conditions, UI responsiveness remains strong. Transactions usually feel smooth, and latency stays predictable through effective application performance management.

During extreme peaks, Google Pay tends to prioritize stability over aggressive retries. This reduces retry storms but can occasionally result in delayed confirmations. Failure messages are usually clear, which helps manage user expectations.

Where Google Pay sometimes struggles is recovery speed when external dependencies slow down. The experience remains calm, but users may wait slightly longer for resolution.

PhonePe performance characteristics

PhonePe handles very high transaction volumes and is designed with scale in mind. During peak load, transaction success rates tend to remain stable. The app often performs well in handling retries without overwhelming the system through balanced load testing strategies.

UI responsiveness generally holds up, although occasional slowdowns are visible during extreme spikes. PhonePe performs well in communicating payment status, which reduces user confusion when delays occur.

One trade-off observed is slightly higher latency during peak confirmation stages. The app prioritizes completion reliability over instant feedback.

Paytm performance characteristics

Paytm operates within a broader ecosystem that includes wallets, commerce, and services. This integration adds complexity similar to challenges faced in digital transformation initiatives. During normal usage, performance feels consistent and familiar to frequent users.

Under peak load, Paytm shows mixed behavior. Transaction success rates remain competitive, but UI responsiveness can feel heavier due to ecosystem load. Retry handling is active, which helps many transactions complete but can occasionally amplify delays during congestion.

Failure messaging is visible, though sometimes less specific than users would prefer during payment issues.

KPI comparison overview

The table below summarizes indicative performance behavior across key metrics during peak usage. These are observed ranges rather than exact measurements, based on performance testing best practices.

| Metric | Google Pay | PhonePe | Paytm |

|---|---|---|---|

| Transaction success rate | High and stable | Very high | High |

| Peak latency | Low to moderate | Moderate | Moderate to high |

| Retry behavior | Conservative | Balanced | Aggressive |

| UI responsiveness | Strong | Mostly strong | Moderate |

| Failure messaging | Clear and calm | Clear and frequent | Visible but less detailed |

This comparison shows that no app dominates every category. Each makes deliberate trade-offs based on design philosophy.

What each app does well and where each struggles

Google Pay excels in simplicity and predictable behavior. It performs best when stability and calm recovery matter more than speed.

PhonePe stands out in handling scale and retries during peak load. It balances reliability with user communication effectively through site reliability engineering principles.

Paytm benefits from deep ecosystem integration but pays a performance cost during heavy usage. Its challenge lies in keeping UI responsiveness high while supporting many services.

These differences highlight that performance is shaped by product decisions, not just engineering effort.

What banks and fintechs can learn from these apps

There are valuable lessons beyond comparison that apply to banking technology transformation.

First, peak performance matters more than average metrics. Research from Forrester indicates that 88% of customers won’t return to a platform after a poor digital experience during critical moments.

Second, retries must be controlled carefully. More retries do not always mean better outcomes. Root cause analysis shows that aggressive retry strategies can worsen system congestion.

Third, failure messaging is part of performance. Clear communication through real user monitoring reduces frustration even when systems are slow.

Finally, performance is a product choice. Decisions about simplicity, integration, and recovery shape user trust as much as raw speed. Banks and fintechs that design for stress conditions, not just ideal flows, through comprehensive quality assurance, build systems users rely on.

Final thoughts

The performance battle between Google Pay, PhonePe, and Paytm in 2026 shows one clear truth: there is no single definition of “best.” Each app succeeds by making conscious trade-offs aligned with its ecosystem and users.

For banks and fintechs, the takeaway is not to copy features but to learn how performance choices impact trust at scale. Systems that fail gracefully often earn more loyalty than those that fail silently. According to IDC research, organizations that invest in proactive performance engineering see up to 40% reduction in customer-impacting incidents.

At Avekshaa Technologies, we work closely with financial platforms to understand real-world performance behavior under stress and help teams engineer systems that remain reliable during peak moments. If you are evaluating how your payment systems perform when it matters most, now is the right time to start that conversation. Explore our financial services expertise and case studies to see how we’ve helped leading platforms.

Frequently Asked Questions

1. What does performance mean in the context of UPI apps?

Performance refers to how reliably and quickly a UPI app completes transactions, how it handles failures, and how clearly it communicates with users during delays or issues through effective monitoring strategies.

2. Why is transaction success rate more important than speed?

A fast app that fails payments is unreliable. Users value successful and predictable transactions more than marginal speed improvements. Application performance engineering prioritizes reliability over speed alone.

3. What causes performance issues during peak UPI usage?

Sudden traffic spikes, downstream latency, retry amplification, and UI load can all contribute to performance degradation during peak periods. Performance testing helps identify these bottlenecks proactively.

4. Are the performance numbers in this blog official metrics?

No. The numbers and observations are indicative and based on real-world usage patterns and publicly observed behavior, not internal data from the companies.

5. Why does failure messaging matter so much in payment apps?

When users do not know what is happening with their money, anxiety increases. Clear messages help maintain trust even when transactions are delayed. Digital customer experience depends on transparent communication.

6. Do retries always improve transaction success?

Not always. Controlled retries can help, but aggressive retries during congestion can overload systems and worsen delays. Site reliability engineering principles emphasize smart retry strategies.

7. Why do apps behave differently under peak load compared to normal usage?

Peak usage introduces concurrency pressure and dependency delays that are not visible during average traffic conditions. Load testing reveals these hidden issues.

8. Is UI responsiveness really part of performance?

Yes. If an app freezes or becomes unresponsive, users perceive the entire system as unreliable, even if the backend eventually completes the transaction. Functional testing ensures UI remains responsive under stress.

9. Can banks and fintechs apply lessons from consumer UPI apps?

Absolutely. Concepts like peak planning, graceful failure, and clear user communication apply directly to enterprise payment systems. Digital transformation strategies benefit from these learnings.

10. What is the biggest takeaway for fintech leaders from this comparison?

Performance is a product decision, not just a technical one. How systems behave under stress shapes user trust more than feature lists or marketing claims. Performance engineering consultation helps align technical capabilities with business goals.