Imagine opening a bank account, sending money, or checking your balance, all without visiting a branch. That is exactly what neobanks offer.

These digital-only banks are changing how people manage money by providing fast, app-based services that fit easily into everyday life.

But here is the catch: when everything happens online, trust works differently. There are no friendly tellers or physical offices to rely on.

For neobanks, trust is earned through a smooth, secure, and always-available digital experience. That means technical performance is not just important, it is essential.

This blog explores how modern neobank business models depend on strong technical performance to win and keep customer trust.

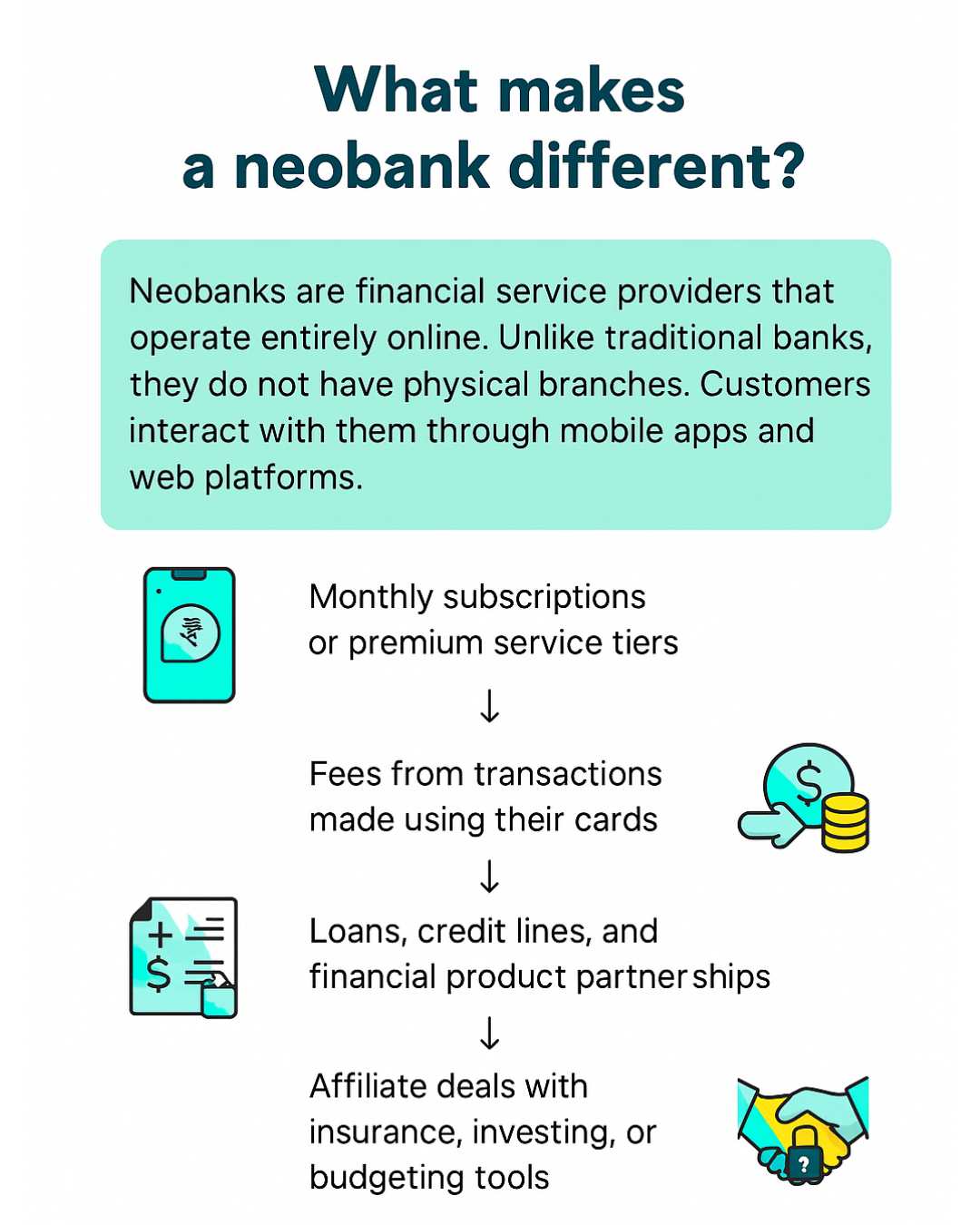

What Makes a Neobank Different?

Neobanks are financial service providers that operate entirely online. Unlike traditional banks, they do not have physical branches. Customers interact with them through mobile apps and web platforms.

Most neobanks make money through:

- Monthly subscriptions or premium service tiers

- Fees from transactions made using their cards

- Loans, credit lines, and financial product partnerships

- Affiliate deals with insurance, investing, or budgeting tools

Their main advantages are ease of use, lower fees, faster onboarding, and smarter digital tools. But these benefits only matter if the technology behind them works seamlessly, every time.

Real-World Examples: When Performance Builds or Breaks Trust

In digital banking, trust can be fragile—and performance issues often spark strong reactions.

A high-profile case occurred in October 2019, when Chime, a popular U.S. neobank, experienced a major outage that paused withdrawals, blocked card transactions, and locked customers out of their accounts for more than a day.

One user told Business Insider, “This is definitely going to make me reconsider using my Chime account”

On the flip side, other neobanks that invested heavily in application performance management, scalable architectures, and real-time monitoring have managed traffic surges during peak times without disruptions.

Their reliability has earned customer loyalty and positive reviews. When performance is treated not as a backend function but as a business-level priority, it becomes a powerful competitive differentiator.

Why Trust Is Tied to Technical Performance

In a traditional bank, if your card stops working or you cannot access your account, you can visit a branch for help. In a neobank, the app is your only point of contact. That is why performance issues are not just technical glitches, they are trust issues.

When an app crashes, transfers are delayed, or security feels shaky, customers lose confidence. Some common issues that can quickly damage trust include:

- App unavailability during key hours

- Failed or delayed transactions

- Login issues or password errors

- Bugs that make the app freeze or crash

- A lack of timely support when problems occur

If these problems happen more than once, many users simply leave. Trust, once broken, is hard to rebuild.

How Technical Performance Builds Customer Confidence

Let us look at four key areas where performance plays a direct role in customer experience and long-term trust.

Speed and Availability

Customers expect their banking app to be available all the time, not just during business hours. Quick loading times, fast transfers, and instant alerts are no longer nice-to-haves. They are basic expectations. Even a delay of a few seconds during a payment or login can create stress and raise doubts.

Scalability

When a neobank grows, so does the demand on its servers and systems. Platforms that are not built to handle this growth may start slowing down or even crashing during high-traffic periods.

The best neobanks use scalable architectures that grow with user demand, keeping the experience smooth even during peak usage.

Security and Resilience

Trust and security go hand in hand. Neobanks deal with sensitive financial data, so customers need to feel that their money and personal information are safe.

That means using strong encryption, multi-factor authentication, secure logins, and always-on monitoring to detect suspicious activity.

Equally important is the ability to recover quickly if something goes wrong. Neobanks must have backup systems, real-time failover capabilities, and disaster recovery plans to keep services running without disruption.

App Performance Monitoring

Monitoring app performance in real time helps identify and fix problems before users notice them.

With tools that track how the app performs across different devices, locations, and connection types, technical teams can catch slowdowns, crashes, and bugs early.

This is where app performance monitoring becomes a key part of building customer trust. By continuously watching how the platform behaves, neobanks can improve stability and reduce frustration for users.

What Happens When Performance Fails?

There have been cases where neobanks faced outages or major delays during critical times like salary days or holidays. Customers who could not access their money or complete transactions took to social media to express frustration.

Even if the issue lasted just a few hours, the damage to trust and reputation often lasted much longer.

On the other hand, platforms that consistently deliver strong performance, even under pressure, tend to build loyal user bases.

Their customers feel secure, valued, and more willing to explore premium services. This is where application performance management becomes a real differentiator.

By focusing on both the big picture and the small details of performance, leading neobanks avoid service interruptions and deliver a dependable user experience.

Best Practices for Engineering Performance in Neobanks

Here are some proven practices that neobanks can use to stay ahead:

Continuous Application Performance Testing

Regularly test the app across devices, networks, and scenarios to catch issues before deployment.

Real-Time Monitoring

Track performance in live environments. This allows teams to act quickly when problems arise.

Scalable Cloud Infrastructure

Use cloud systems that can automatically adjust to changing demand. This avoids slowdowns during traffic spikes.

Resilience and Recovery Planning

Build in systems that can handle failures gracefully and recover quickly, so users stay connected without disruption.

User-Centered Feedback Loops

Collect feedback from real users and use that data to improve performance with each release.

These strategies make sure performance is not just a technical task. It becomes part of product design, customer service, and business growth.

Why Performance Is a Competitive Advantage

In the crowded fintech space, most neobanks offer similar services. What sets one apart from the others is not just pricing or design, but reliability.

A platform that is fast, secure, and always available gives customers peace of mind and that is what keeps them coming back. Strong performance also attracts investors and partners.

It shows that the neobank is built for scale and ready for serious growth. Regulators, too, look for platforms that can operate reliably and securely at all times.

In short, technical performance becomes a competitive advantage not just for customer trust, but for the future of the business itself.

Conclusion

For neobanks, technical performance is more than a backend requirement, it is the engine of customer trust.

Every action a user takes on the app is an opportunity to either build confidence or risk losing it. Smooth transactions, reliable access, and secure systems are no longer optional, they are expected.

Neobanks that prioritize performance at every level, from infrastructure to user experience, stand out in a crowded market. They retain customers, earn better reviews, and attract investor and regulatory confidence.

In the digital banking space, trust is not earned through advertising or design alone. It is earned through consistent, high-quality performance delivered every day.

Explore How We Can Help

Avekshaa helps digital-first financial platforms deliver high-performance, secure, and scalable experiences. From application performance testing to real-time monitoring and production management, our solutions support fintech businesses in building trust through technology.

Explore Our Services.

Frequently Asked Questions (FAQs)

1. What is a neobank, and how is it different from a traditional bank?

A neobank is a digital-only financial institution that operates entirely online, usually through mobile apps and websites. Unlike traditional banks, neobanks do not have physical branches and typically offer faster onboarding, lower fees, and tech-driven services.

2. Why is technical performance so important for neobanks?

Since neobanks operate entirely online, users rely on apps and websites to perform all financial activities. Any downtime, delay, or glitch can directly impact trust, causing frustration or even customer churn. Strong performance builds confidence in the brand.

3. What kind of performance issues can hurt a neobank’s reputation?

Common issues include slow app loading, failed transactions, login errors, or outages during peak times. If customers experience these frequently, they may stop using the platform altogether.

4. How does app performance monitoring help neobanks?

App performance monitoring allows teams to track system behavior in real time. It helps detect issues before they affect users, ensuring the platform remains stable, fast, and secure. This is essential for building long-term trust.

5. What is application performance testing, and when is it done?

Application performance testing involves checking how software behaves under various conditions such as high user load or network stress. Neobanks use it before deployment and during updates to make sure the app performs well in real-world scenarios.

6. Can performance issues affect a neobank’s business model?

Yes. A poor user experience can lead to higher churn rates, lower customer satisfaction, and negative reviews. Since many neobanks rely on transaction volume and user engagement, technical failures can impact revenue and growth.

7. How can scalability affect a neobank’s growth?

Scalability ensures that a neobank can serve more users without slowing down or crashing. Platforms that scale well are better equipped to handle spikes in activity like holidays or salary days without sacrificing performance.

8. What are the key components of technical trust in neobanking?

The main elements include high app uptime, fast transactions, secure data handling, and quick problem resolution. Together, these create a smooth experience that users trust and return to.

9. How does security tie into performance?

Security and performance go hand in hand. An app that performs well but lacks strong security can still lose customer trust. Likewise, a secure system that is too slow or unreliable will not keep users happy. Both need to work together.

10. How can Avekshaa support neobanks in building reliable systems?

Avekshaa offers solutions like application performance testing, real-time monitoring, and production management. These services help neobanks maintain smooth, secure, and scalable platforms that deliver consistent user experiences.